Business Credit

Welcome to our DIY Business Credit Builder!

Stop Using Personal Credit To Run Your Business!

Get started with our comprehensive DIY business credit Builder!

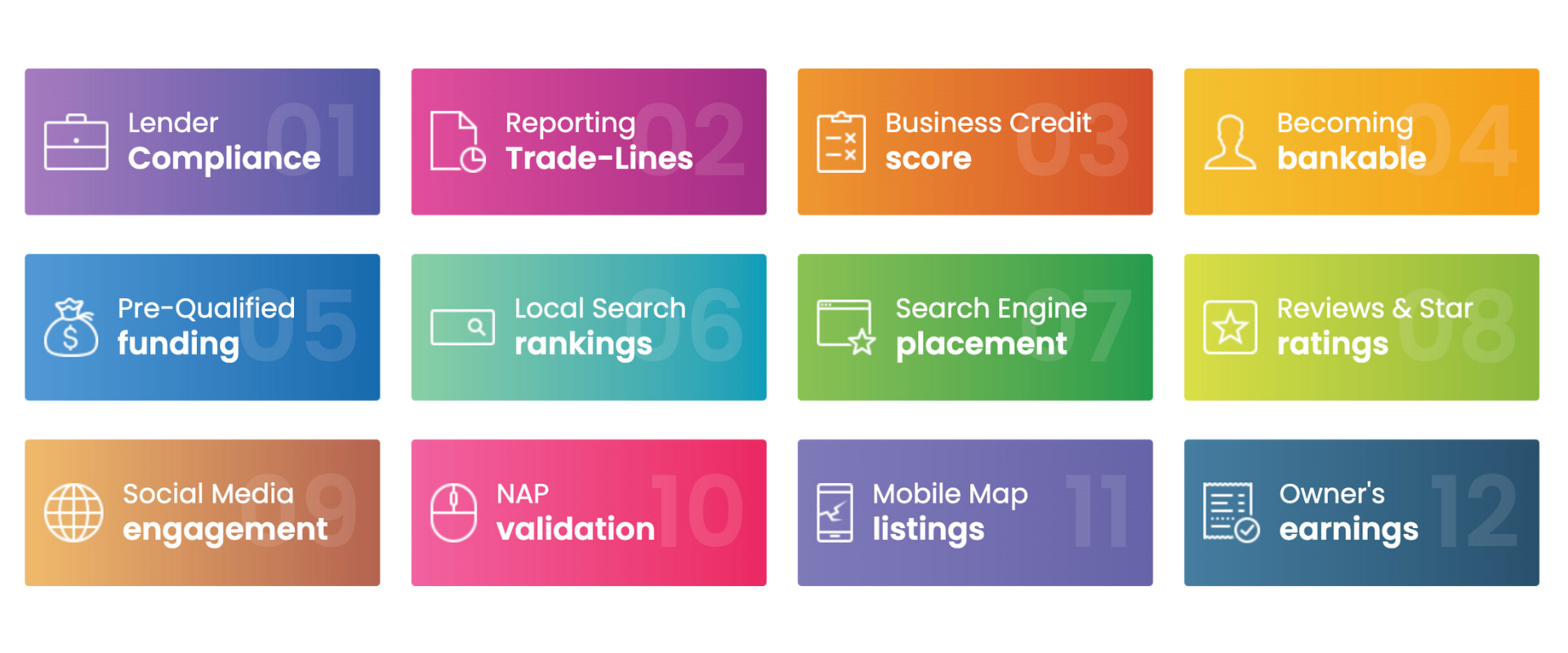

WHAT YOU'LL LEARN

Lender compliance, in the context of building business credit, refers to ensuring that a business meets the specific requirements and standards set by financial institutions and credit agencies. This includes maintaining accurate and consistent business information across public records, having proper licensing, establishing a professional business presence (like a dedicated phone number and business bank account), and demonstrating financial responsibility. Compliance helps businesses appear credible and low-risk to lenders, significantly improving their chances of securing funding and building a strong business credit profile over time.

Becoming bankable means positioning your business in a way that makes it attractive to traditional lenders like banks. It involves establishing a strong financial foundation, including maintaining a business bank account, demonstrating consistent revenue, managing debt responsibly, and ensuring your business entity is properly registered. Being bankable shows lenders that your business is stable, trustworthy, and capable of managing borrowed funds.

Listing your business on local directories is a crucial step in building credibility and visibility. Accurate, consistent listings across platforms like Google My Business, Yelp, and local Chamber of Commerce directories help lenders verify your legitimacy. These directories not only enhance your business’s online presence but also play a role in lender and vendor validation when evaluating your creditworthiness.

Business scores are numerical ratings that represent the financial health and risk level of your business, similar to a personal credit score. Agencies like Dun & Bradstreet, Experian, and Equifax Business assign these scores based on payment history, credit utilization, and public records. A strong business score can unlock better financing options, lower interest rates, and greater opportunities for growth.

Positive reviews and high ratings reflect customer satisfaction and can significantly impact your business’s reputation. Lenders often look at your online presence, including customer feedback, as part of their risk assessment. Consistent, favorable reviews show that your business is reliable and trustworthy, supporting stronger credit-building and funding opportunities.

Vendor credit refers to the practice of buying goods or services from suppliers and paying for them later, typically on net terms like 30, 60, or 90 days. Establishing vendor credit helps build your business credit profile by creating tradelines that report positive payment history to credit agencies. It's often the first and easiest step for new businesses to start building a strong credit foundation.

Pre-qualifying for funding allows businesses to gauge their eligibility for loans or credit lines without impacting their credit scores. This process involves a soft inquiry and a review of key financial indicators, offering insight into available financing options. Pre-qualification helps businesses understand their standing and prepare stronger, more targeted applications for full approval.

Alternative financing refers to non-traditional funding sources outside of standard bank loans, such as online lenders, invoice factoring, merchant cash advances, and crowdfunding. These options are often more accessible to small businesses or startups that may not yet meet strict bank criteria. Alternative financing can be an important stepping stone in building business credit and sustaining growth.

Business credit cards are a powerful tool for managing expenses and building business credit. They separate personal and business finances, provide a revolving credit line, and report payment activity to business credit bureaus. Responsible use of business credit cards—such as paying balances on time and keeping utilization low—can significantly boost a company's creditworthiness and financial flexibility.

- How to Prepare & Present a Successful Business Funding Request

- How to Build Your Business Credit Scores ... Fast

- The Art and Science of Obtaining Venture or Angel Investor Capital

- Start A Business - Where To Begin and How To Grow

- Personal Credit - A Guide to Excellent Personal Credit Scores

EVEN MORE!

A video library

A list of 3000 Credit Vendors with net terms.

200+ Direct Lending options through our Funding Program.

Unlimited Lifetime Access!

No ongoing subscription.

- BECOME BANKABLE

- BUILD BUSINESS CREDIT

- COMPLETE CREDIT & FUNDING MANAGEMENT SYSTEM

- FULL BUSINESS REGISTRATION WITH BUSINESS CREDIT BUREAUS

- VIRTUAL ASSISTANCE ON EACH STEP

- LENDER AND CREDIT COMPLIANCE SUITE - 20 KEY POINTS

- 3000+ VENDoR CREDIT LENDERS WITH NET TERMS

- 200+ DIRECT LENDERS FOR TRADITIONAL FUNDING

- SOCIAL MEDIA / WEBSITE COMPLIANCE DASHBOARD

- MARKETING TOOLS

- AND MORE..

Join Today And Get The Startup Series FREE!

Free Ebooks

- How to Prepare & Present a Successful Business Funding Request

- How to Build Your Business Credit Scores ... Fast

- The Art and Science of Obtaining Venture or Angel Investor Capital

- Start A Business - Where To Begin and How To Grow

- Personal Credit - A Guide to Excellent Personal Credit Scores

Help Your Business Become Bankable!

VIRTUAL ASSISTANCE

- Step By Step Walk through

- Video Avatar Instructors

- Course Benchmarks

- Downloadable Guides

- And More

LENDER COMPLIANCE

- Communication Standards

- Web Presence & Security

- Directory Presence

- Social Media Presence

- +16 More Critical Points

TRADE LINES

- No Personal Guarantees

- Tier 1, 2 and 3 Lenders

- Strategy Guide - How To

- Paydex Scores

- And More